Quarterly Personal Budget Template

In this article, we offer a quarterly personal budget template that you can use to up your income and expenses in a quarter. You just need to consider every expense as well as income over three months. Add your bills such as housing, food, entertainment, and transport, and expenses for more fun like dining out or going to travel. Your fixed spending should not be over the income you make during the last three months or quarterly. Creating a good quarterly personal budget provides you access after your quarter period is over, so then you’ll add your extra money to your savings.

Quarterly budgets give a scenario to plan on a micro-level. It will allow you to track and adjust income in three-month increments. By creating this opportunity for path correction throughout the year, you can manage your annual bottom line despite unexpected changes in your income or expenses. This opportunity to pivot sets a better stage for your long-term financial goals and flexibility. Just because in the end, a surplus always comes from expenses less than your income.

Free Quarterly Personal Budget Template

Download Size: 36 KB

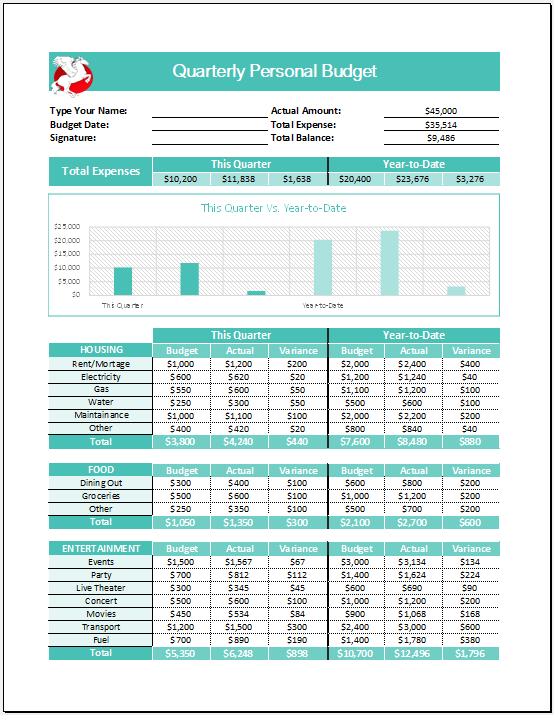

Quarterly Personal Budget TemplateThis great quarterly personal budget template is designed and structured in Microsoft Excel format. Using this customized budget planner, you can manage all your personal or housing expenses quarterly. All the given values for each category will be calculated automatically using built-in formulas. On the other hand, the chart displayed in the picture will also provide you with an overview of quarterly expenses toward YTD. If you need this accessible quarterly budget planner for free, just click on the download button next to this sample image.

Why Do We Need a Quarterly Budget?

A quarterly budget for personal use is a time-friendly budget because it requires less time than other shorter and larger budgets. In a short and long budget, you must calculate your result carefully and need much time to remember expense details for each category. Whereas a quarterly budget requires calculating the results four times a year. Therefore, you can easily remember the result of your spending for each category.